WOODCLIFF LAKE, NJ – MAY 1, 2024 – Hudson Technologies, Inc. (NASDAQ: HDSN) announced results for the first quarter ended March 31, 2024.

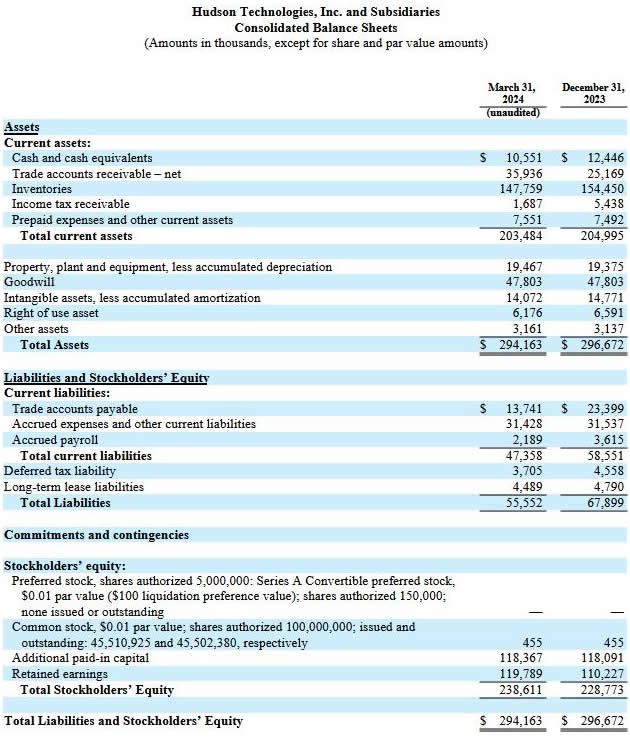

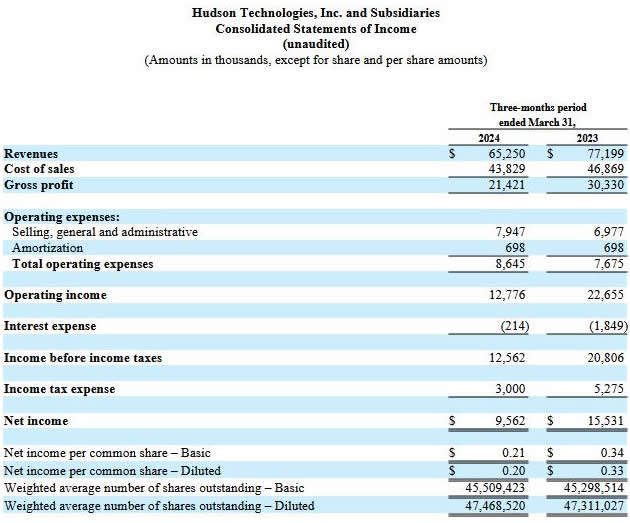

For the quarter ended March 31, 2024, Hudson reported revenues of $65.3 million, a decrease of 15% compared to revenues of $77.2 million in the comparable 2023 period. The decrease is primarily related to decreased selling prices for certain refrigerants as well as lower revenue from the Company’s DLA contract in the quarter compared to the first quarter of 2023. Gross margin in the first quarter of 2024 was 33%, compared to 39% in the first quarter of 2023. Hudson reported operating income of $12.8 million in the first quarter of 2024, compared to operating income of $22.7 million in the prior year period. The Company recorded net income of $9.6 million or $0.21 per basic and $0.20 per diluted share in the first quarter of 2024, compared to net income of $15.5 million or $0.34 per basic and $0.33 per diluted share in the same period of 2023.

Brian F. Coleman, President and Chief Executive Officer of Hudson Technologies commented,

“Our 2024 selling season has kicked off largely as we expected, with our first quarter revenues reflecting a difficult comparison to the first quarter of 2023, which reflected higher sale prices for certain refrigerants as well as higher volume from our DLA contract. During the first quarter of 2024, the industry saw pricing for certain refrigerants decline by approximately 20% as compared to pricing levels in the first quarter of 2023.

“In the event that current pricing levels continue for the balance of the 2024 selling season, we would anticipate full year revenue in the range of $250 to $265 million, with gross margin below our targeted 35%. Given the ongoing stepdown in virgin HFC production, as supply tightens, we would expect to see an increase in the sales price for certain refrigerants and the achievement of our long-range gross margin target of 35%, but the timing is difficult to predict. In the meantime, the current lower pricing dynamic provides us the opportunity to replenish our inventory with lower cost refrigerants as we move through the 2024 cooling season. To the extent that the current pricing dynamic that we have seen in the first quarter of 2024 continues through the sales season, then we would not expect to meet our previously stated 2025 revenue and gross margin targets.”

Mr. Coleman concluded, “As we have often mentioned, our selling season comprises nine months, and we believe the 2024 season will provide us with enhanced visibility around the ongoing HFC phasedown and corresponding supply/demand dynamics as we navigate the 40% stepdown in virgin HFC production and consumption. Additionally, the EPA’s proposed Refrigerant Management rule is expected to be finalized in late summer and includes proposed language mandating the use of reclaimed refrigerants for certain applications and equipment. While 2024 may not unfold as favorably as previously expected, it is important to reiterate our confidence that the phasedown of HFC will ultimately move pricing higher, accelerate reclamation adoption and drive enhanced profitability in our business. With our industry leading reclamation technology and established customer network, we believe Hudson is well positioned to benefit from the continued implementation of the AIM Act as virgin HFC refrigerant production and consumption is reduced and the industry begins to rely more meaningfully on reclaimed refrigerants to service the existing installed base of cooling and refrigeration equipment.”