WOODCLIFF LAKE, NJ – MARCH 6, 2024 – Hudson Technologies, Inc. (NASDAQ: HDSN) announced results for the fourth quarter and year ended December 31, 2023.

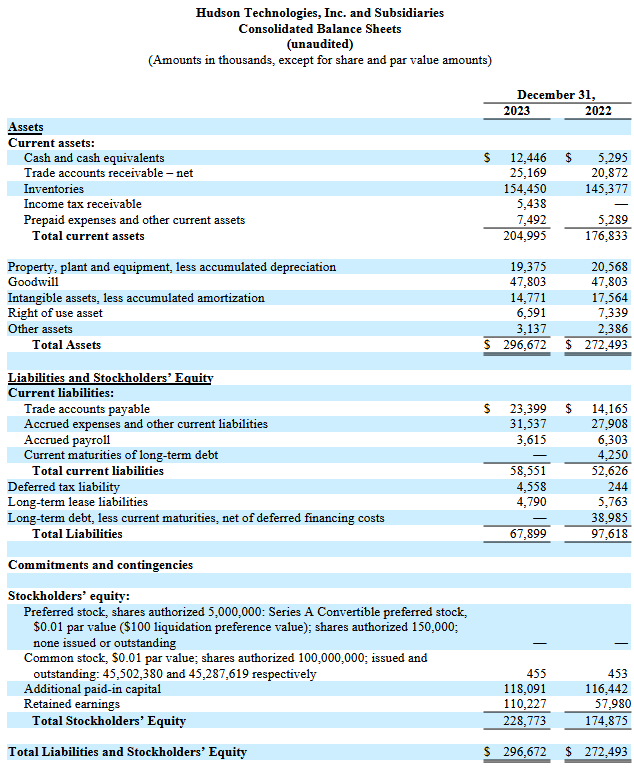

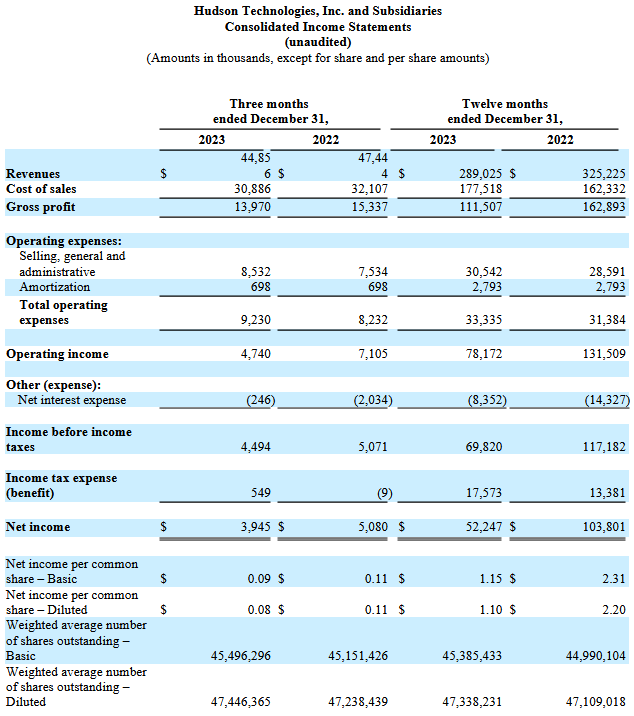

For the quarter ended December 31, 2023, Hudson reported revenues of $44.9 million, a decrease of 5% compared to revenues of $47.4 million in the comparable 2022 period. The decrease is primarily related to decreased selling prices for certain refrigerants, offset by slightly higher volume. Gross margin in the fourth quarter of 2023 was 31%, compared to 32% in the fourth quarter of 2022. Hudson reported operating income of $4.7 million in the fourth quarter of 2023, compared to operating income of $7.1 million in the prior year period. The Company recorded net income of $3.9 million or $0.09 per basic and $0.08 per diluted share in the fourth quarter of 2023, compared to net income of $5.1 million or $0.11 per basic and diluted share in the same period of 2022.

For the year ended December 31, 2023, Hudson reported revenues of $289.0 million, a decrease of 11% compared to revenues of $325.2 million for full year 2022. Revenue for the full year 2023 declined primarily related to decreased selling prices for certain refrigerants. Included in the full year 2023 revenues was approximately $53 million from the Company’s Defense Logistics Agency (“DLA”) contract, which represented a record annual revenue from the contract. The Company estimates that approximately $20 million of 2023 DLA revenue is related to increased DLA-specific program activities that may not be repeated in 2024. Gross margin for full year 2023 was 39%, compared to gross margin of 50% in the prior year period. Hudson reported operating income of $78.2 million for full year 2023 compared to operating income of $131.5 million in the prior year. The Company recorded net income of $52.2 million or $1.15 per basic and $1.10 per diluted share in 2023, compared to a net income of $103.8 million or $2.31 per basic and $2.20 per diluted share in 2022.

As previously announced, Hudson fully paid off its remaining $32.5 million of term loan debt during the third quarter of 2023. Stockholders’ equity improved to $228.8 million at December 31, 2023 compared to $174.9 million at December 31, 2022.

Brian F. Coleman, President and Chief Executive Officer of Hudson Technologies commented,

“We delivered a solid fourth quarter consistent with historical fourth quarter performance, which is typically our lowest revenue quarter because it falls outside of our nine-month selling season. Despite a 24% decline in pricing during Q4 2023 when compared to Q4 2022, revenues were only down 5%, stemming from higher volume and increased revenues from our DLA contract. Furthermore, for the full year 2023 the business generated cash flow from operations of $58.5 million.”

“We remain optimistic that the ongoing stepdown in HFC production and consumption allowances and the proposed reclamation mandates as a result of the AIM Act will benefit our business. The stepdown in virgin production and consumption now represents 40% of the baseline for 2024 through 2028. As we’ve previously mentioned, we believe that the proposed Refrigerant Management rule will drive higher demand for our reclaimed refrigerants due to the mandates for the use of reclaimed refrigerants in certain sectors. We believe a final rule will be issued this summer. Likewise, we are encouraged by existing and proposed legislation at both the federal and various state levels that promotes the use of reclaimed refrigerant.

“Hudson has held a leadership role in the refrigerant industry for more than thirty years, and we have long been committed to developing sustainable solutions around responsible refrigerant management and the adoption of reclamation. We are uniquely positioned to leverage our expertise and industry-leading reclamation technology to help drive the transition to more efficient cooling equipment and greener refrigerants, while also servicing the existing installed base with reclaimed refrigerants as the industry continues to evolve,” Mr. Coleman concluded.