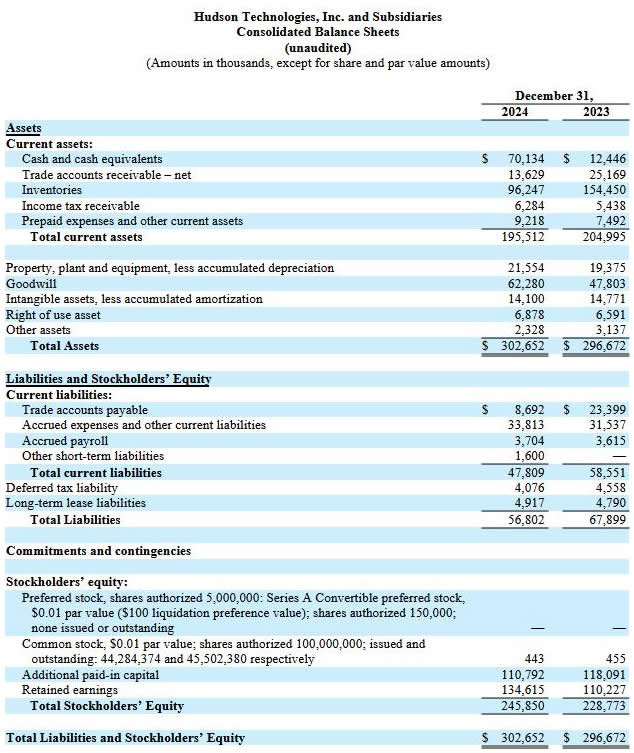

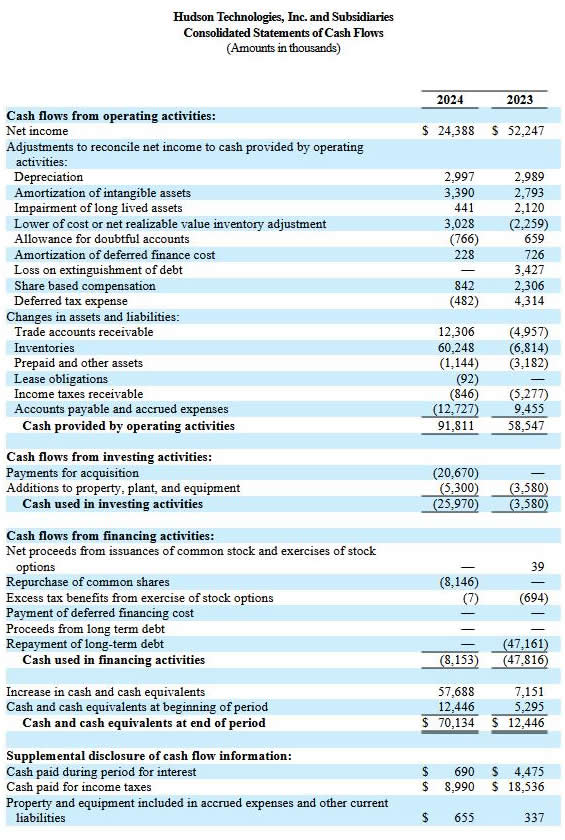

- Strong unlevered balance sheet with $70.1 million in cash and no debt

- Repurchased $8.1 million of common stock in 2024

- Increased refrigerant reclamation volume by 18% in 2024

WOODCLIFF LAKE, NJ – March 6, 2025 – Hudson Technologies, Inc. (NASDAQ: HDSN) announced results for the fourth quarter and year ended December 31, 2024.

Brian F. Coleman, President and Chief Executive Officer of Hudson Technologies commented, “Our fourth quarter 2024 results reflected the seasonally slower sales activity we have historically seen outside of our nine-month selling season. Full year 2024 results reflected a challenging selling season in which market pricing for certain HFC refrigerants declined by up to 45% from last year’s levels which more than offset the slight gains we achieved in sales volume. The decline in refrigerant pricing was driven by higher than anticipated inventory levels up stream in the marketplace built up in advance of the HFC phaseout. During our many decades in this industry, we have successfully weathered unfavorable pricing environments by staying focused on what we can control – ensuring that our customers have the right refrigerants where and when they need them and promoting recovery and reclamation activities as our industry transitions to lower GWP equipment and refrigerants. We navigated 2024 with that focus and remain committed to our operating strategy. In fact, our overall reclaim activity increased 18% in 2024.

“As we move through 2025, we maintain our long-term view that the current phase down of HFC refrigerants creates a significant opportunity for our reclamation business. The installed base of HFC equipment will be operable for many years to come, and as the supply of virgin HFCs becomes limited, reclaimed HFCs will be needed to fill the anticipated supply/demand gap. With that in mind, we are intent on maximizing our recovery and reclamation capabilities, as evidenced by our strategic acquisition of USA Refrigerants in June 2024. Refrigerant recovery is integral to the reclamation process and the USA Refrigerants acquisition provides Hudson access to a previously untapped recovery network. This, coupled with our ongoing efforts to promote recovery in the field, has strengthened our reclaimed refrigerant supply chain. We are now better positioned to continue to grow our leadership position in the reclamation landscape.

“Our strong unlevered balance sheet with $70.1 million in cash and no debt at December 31, 2024 provides us the financial flexibility to continue executing on our three-pillar capital allocation strategy: invest in organic growth; explore acquisition opportunities; and opportunistically repurchase stock. During the fourth quarter, we repurchased $5.5 million of common stock under the stock buyback plan that was originally established in the third quarter of 2024. During full year 2024, the Company repurchased $8.1 million of common stock,” Mr. Coleman concluded.

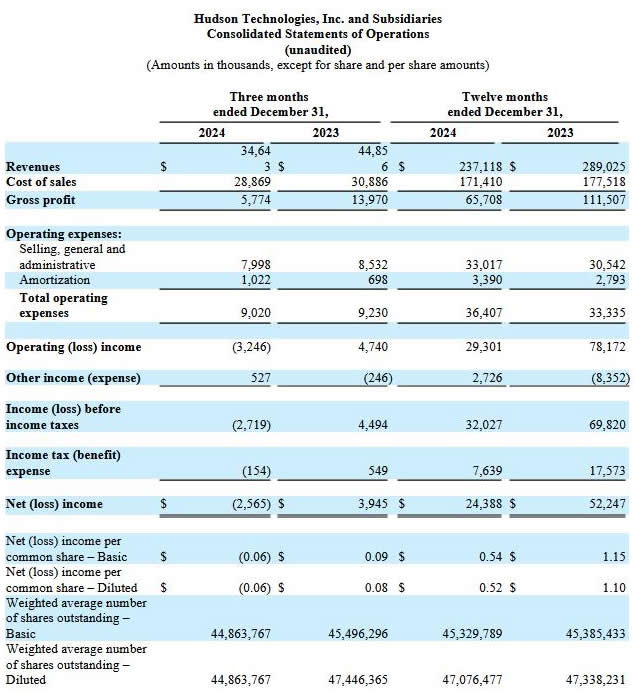

Three Months Results

For the quarter ended December 31, 2024, Hudson reported:

- Revenues of $34.6 million, a decrease of 23% compared to revenues of $44.9 million in the comparable 2023 period. The decrease is related to decreased prices for certain refrigerants and lower DLA activity.

- Gross margin of 17%, compared to 31% in the fourth quarter of 2023. The gross margin compression in 2024 was predominately price driven.

- Selling, general and administrative expenses decreased to $8.0 million compared to $8.5 million in the fourth quarter of 2023.

- Operating loss of ($3.2) million, compared to operating income of $4.7 million in the prior year period.

- Net loss of ($2.6) million or ($0.06) per basic and diluted share in the fourth quarter of 2024, compared to net income of $3.9 million or $0.09 per basic and $0.08 per diluted share in the same period of 2023.

Full Year 2024 Results

- Revenues of $237.1 million, a decrease of 18% compared to revenues of $289.0 million for 2023. Revenues declined due to decreased selling prices for certain refrigerants, partially offset by slightly increased sales volumes. Additionally, as expected, revenue from the Company’s DLA contract during full year 2024 declined as compared to full year 2023 contract revenue, related to surge purchases of approximately $20 million recorded in 2023.

- Gross margin of 28%, compared to gross margin of 39% in full year 2023. The gross margin compression in 2024 was predominately price driven.

- Selling, general and administrative expenses increased to $33.0 million compared to $30.5 million in 2023. Included in the 2024 selling, general and administrative expenses are approximately $0.7 million of costs associated with the USA Refrigerants acquisition and IT expenses.

- Operating income of $29.3 million compared to operating income of $78.2 million in 2023.

- Net income of $24.4 million or $0.54 per basic and $0.52 per diluted share, compared to net income of $52.2 million or $1.15 per basic and $1.10 per diluted share in full year 2023. Net income in full year 2024 included approximately $2.3 million of non-recurring income, arising in part from proceeds of a litigation settlement.

Conference Call Information

Hudson Technologies will host a conference call and webcast on Thursday, March 6, 2025 at 5:00 p.m. Eastern Time to discuss the Company’s fourth quarter and full year 2024 results.

Please visit this link at least 5 minutes prior to the scheduled start time in order to register and receive dial-in and webcast details.

A replay of the teleconference will be available until April 5, 2025, and may be accessed by dialing (877) 481-4010. International callers may dial (919) 882-2331. Callers should use conference ID: 52007.