WOODCLIFF LAKE, NJ – August 6, 2024 – Hudson Technologies, Inc. (NASDAQ: HDSN) announced results for the second quarter and six months ended June 30, 2024.

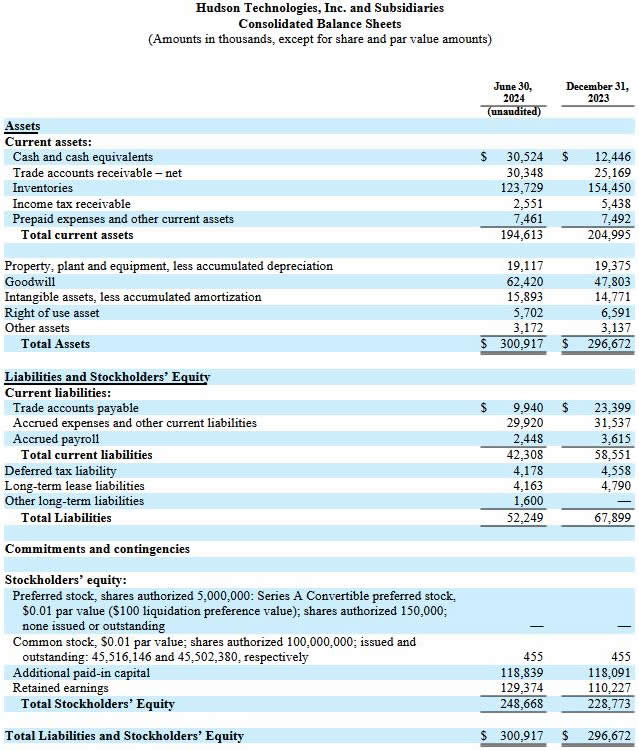

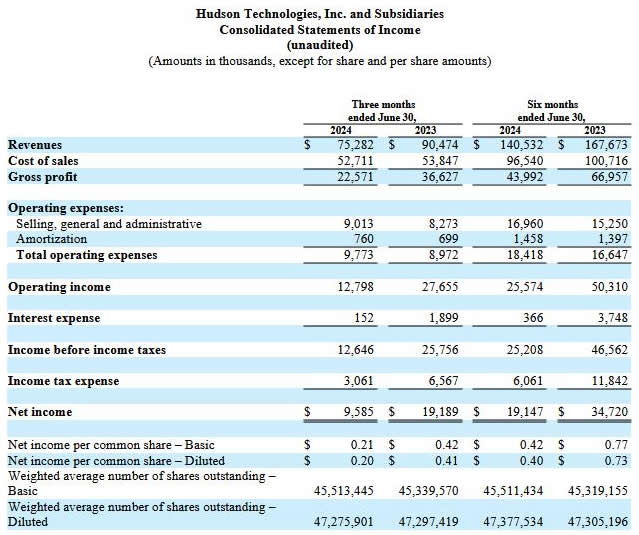

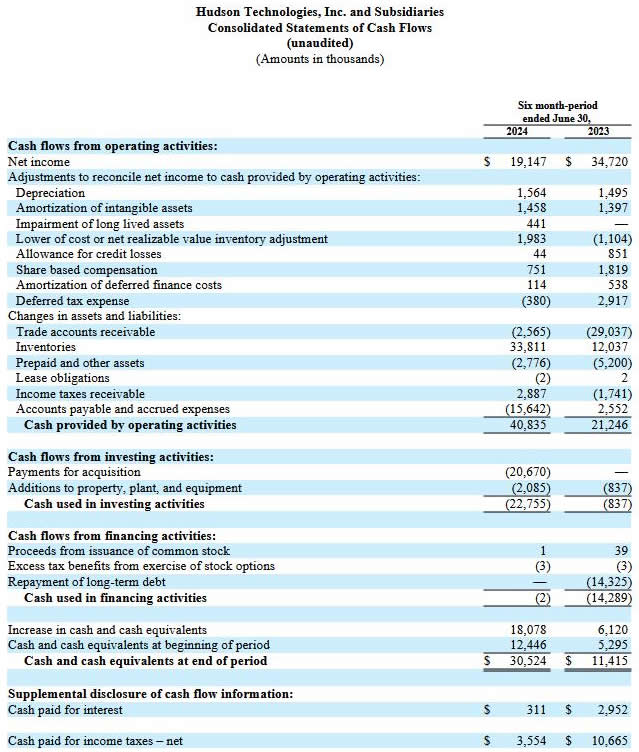

For the quarter ended June 30, 2024, Hudson reported revenues of $75.3 million, a decrease of 17% compared to revenues of $90.5 million in the comparable 2023 period. The decrease is primarily related to decreased selling prices for certain refrigerants, lower revenue from the Company’s DLA contract and reduced carbon credit revenue in the quarter compared to the second quarter of 2023. This was partially offset by an increase in volume of 17% for refrigerants sold when compared to the same quarter last year. Gross margin in the second quarter of 2024 was 30%, compared to 41% in the second quarter of 2023. Hudson reported operating income of $12.8 million in the second quarter of 2024, compared to operating income of $27.7 million in the prior year period. Included in the second quarter 2024 selling, general and administrative expenses are approximately $0.7 million of non-recurring costs associated with the USA acquisition and IT expenses. The Company recorded net income of $9.6 million or $0.21 per basic and $0.20 per diluted share in the second quarter of 2024, compared to net income of $19.2 million or $0.42 per basic and $0.41 per diluted share in the same period of 2023.

For the six months ended June 30, 2024, Hudson reported revenues of $140.5 million, a decrease of 16% compared to revenues of $167.7 million for the first six months of 2023. Revenues for the first six months declined primarily due to decreased selling prices for certain refrigerants as well as lower revenue from the Company’s DLA contract, partially offset by an increase in the volume of refrigerants sold. Gross margin for the first half of 2024 was 31%, compared to gross margin of 40% in the first half of 2023. Hudson reported operating income of $25.6 million for the first six months of 2024 compared to operating income of $50.3 million in the first six months of 2023. The Company recorded net income of $19.1 million or $0.42 per basic and $0.40 per diluted share in the first half of 2024, compared to net income of $34.7 million or $0.77 per basic and $0.73 per diluted share in the first six months of 2023.

Brian F. Coleman, President and Chief Executive Officer of Hudson Technologies commented,

“Despite stronger refrigerant sales volume, our second quarter financial performance reflected the continued headwinds of pricing pressure for certain refrigerants combined with lower activity levels from our DLA contract as compared to last year. During the second quarter of 2024, the industry saw pricing for certain refrigerants decline by approximately 25% as compared to pricing levels in the second quarter of 2023 and pricing was reduced by approximately 6% from the level we reported at the time of our first quarter earnings call. As we’ve previously stated, we anticipated that pricing levels might not rebound as the season progressed and we recognized that last year’s strong DLA order activity could provide a difficult comparison to this year. While the current pricing landscape is not ideal, we believe this dynamic is temporary and does not impact our long-term view of the growth of our Company. If current pricing levels continue through the remainder of the 2024 selling season, we would anticipate full year revenue in the range of $240 million to $250 million and full year gross margin of approximately 30%.

“We remain focused on executing our strategic plan to ensure that we are meeting the refrigerant needs of our customers and that we are promoting recovery and reclamation activity. During the quarter we announced our acquisition of USA Refrigerants, a leading purchaser of recovered refrigerants, known for their sales organization and expertise in sourcing recovered refrigerants. As a reminder, with the recovered refrigerants we source, process, and sell, we recognize a much higher gross margin than through the purchase and resale of newly manufactured refrigerants. The skillset and industry relationships USA brings, combined with Hudson’s existing customer base, are expected to scale our capabilities around recovery and reclamation, allowing us to significantly enhance our ability to profitably leverage current and future phase downs of virgin refrigerants and the resulting growth in recovered and reclaimed refrigerants.

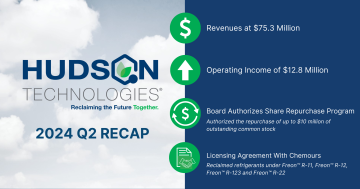

“We continued to strengthen our balance sheet, ending the period with no debt and $30.5 million in cash. This reflects $18.1 million of free cash flow generation for the six-month period ended June 30, 2024, which includes the effect of the $20.7 million cash outflow related to the USA Refrigerants acquisition.”

Mr. Coleman continued, “It is important to reiterate that while our second quarter results are not where we’d like them to be and the market pricing challenges experienced could persist through the balance of this sales season, we remain confident that in the long term, the phasedown of HFCs will ultimately move pricing higher, accelerate reclamation activity and drive enhanced profitability in our business. In the coming month, we expect the finalization of the EPA’s Refrigerant Management Rule, mandating the use of reclaimed refrigerants for certain equipment and service sectors. While 2024 may have its challenges, as the AIM Act legislates limits to future production and consumption of virgin HFCs, we believe Hudson’s leadership position in the industry, proprietary reclamation technology and longstanding customer relationships leave us well positioned to drive the necessary transition to reclaimed refrigerant as virgin supply tightens.”

Board Authorizes Share Repurchase Program

Hudson also announced that its board of directors has authorized the repurchase of up to $10 million of outstanding common stock during 2024 and 2025. Purchases will be funded from the company’s available cash and cash flow. Hudson may purchase shares of its common stock on a discretionary basis from time to time through open market repurchases or privately negotiated transactions or through other means, including by entering into Rule 10b5-1 trading plans, in each case, during an “open window” and when the Company does not possess material non-public information. The timing and actual number of shares repurchased under the repurchase program will depend on a variety of factors, including stock price, trading volume, market conditions, corporate and regulatory requirements and other general business considerations. The repurchase program may be modified, suspended or discontinued at any time without prior notice.

Mr. Coleman commented, “We’ve previously noted that the three pillars to our capital allocation strategy are: business working capital needs, acquisitions and share repurchases. The board’s authorization of a share repurchase program reflects their confidence in Hudson’s long-term growth prospects and dedication to stockholder value creation. Given our significantly improved balance sheet over the past few years, we are now able to prioritize investing for growth organically and through acquisition, while also potentially returning capital to our stockholders through the repurchase of stock.”