Pearl River, NY – November 14, 2019 – Hudson Technologies, Inc. (NASDAQ: HDSN) announced results for the third quarter and nine months ended September 30, 2019.

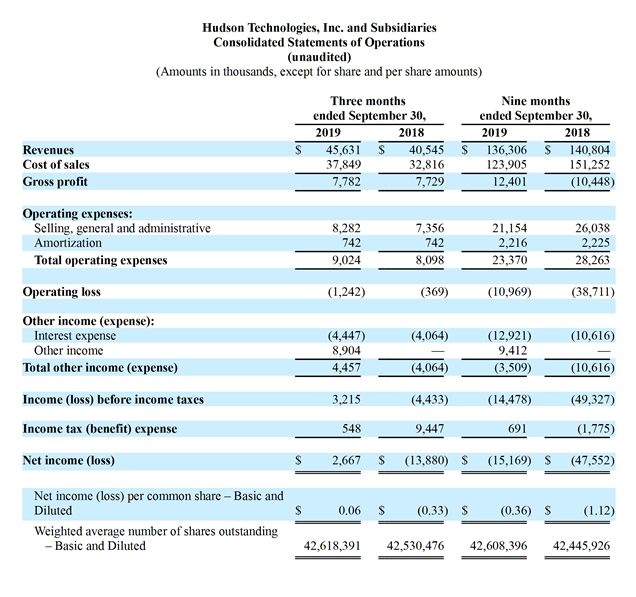

For the quarter ended September 30, 2019 Hudson reported revenues of $45.6 million, an increase of 13% compared to $40.5 million in the comparable 2018 period. The increase in revenues was due to an increase in refrigerant volumes and growth with the DLA contract, offset by a decline in prices of certain refrigerants sold during the 2019 quarter when compared to 2018. Selling, general and administrative (“SG&A”) expenses for the three-month period ended September 30, 2019 were $8.3 million, compared to $7.4 million in the comparable 2018 period. The increase in SG&A was primarily attributable to professional fees and insurance expense. The Company’s net income for the third quarter of 2019, was $2.7 million, or $0.06 per basic and diluted share. During the third quarter of 2019, the Company received $8.9 million in proceeds from the working capital settlement arising from the acquisition of Aspen Refrigerants, Inc. (“ARI”). Net loss for the third quarter of 2018 was $13.9 million or $(0.33) per basic and diluted share. Included in the $13.9 million third quarter 2018 loss are approximately $9 million in non-cash charges related to a deferred tax reserve and approximately $2 million in non-recurring charges related to the acquisition and integration of ARI.

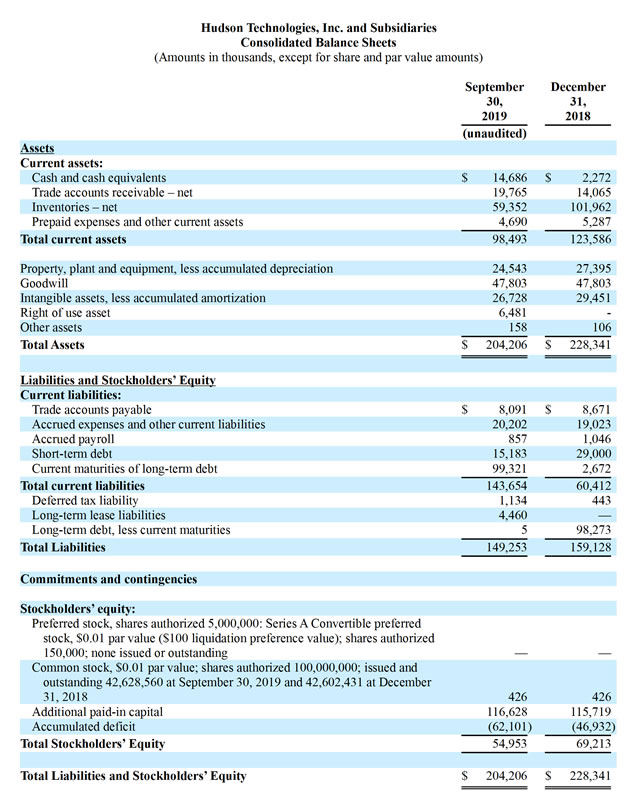

For the nine months ended September 30, 2019, Hudson reported revenues of $136.3 million compared to $140.8 million in the comparable 2018 period. Refrigerant selling prices declined in 2019 when compared with 2018. The overall decline in revenues was partially offset by an increase in overall refrigerant volumes and revenue from the DLA contract. SG&A expenses for the nine-month period ended September 30, 2019 were $21.2 million, compared to $26.0 million in the comparable 2018 period. The decrease in SG&A was primarily attributable to reduced payroll-related expenses, advertising and other professional fees in the first nine months of 2019. Net loss for the first nine months of 2019, which includes a $9.2 million inventory adjustment offset by the $8.9 million of settlement proceeds, was $15.2 million, or ($0.36) per basic and diluted share. Net loss in the first nine months of 2018, which included a $34.7 million inventory adjustment, was $47.6 million, or $(1.12) per basic and diluted share.

Loan Covenant Defaults

The Company failed to comply with the financial covenants contained in its term loan facility and its revolving credit facility at September 30, 2019 and is currently in default under those agreements. Other than the financial covenants, the Company has fully complied with all of its debt payment and other obligations on a timely basis. Despite the covenant violations, the Company had over $23 million of availability pursuant to the borrowing base formula in its revolving loan facility as of September 30, 2019. During the third quarter of 2019, the Company utilized its cash from operations to pay over $18 million of debt. As such, the Company does not believe that the covenant defaults relate to a liquidity issue, but relate to a leverage issue under the current covenant structure. The Company is currently seeking a waiver and amendment from its lenders to waive the covenant defaults and reset the financial covenants under both the term loan facility and the revolving credit facility. However, the lenders have the right to declare all amounts under these facilities to be immediately due and payable, and there can be no assurance that the Company will be able to obtain any such waivers or amendments on acceptable terms or at all.

Kevin J. Zugibe, Chairman and Chief Executive Officer of Hudson Technologies commented, “During the third quarter, we saw an increase in volume due to Hudson’s ability be more competitive as we sold through a large portion of our higher priced inventory. Pricing through the third quarter remained relatively consistent with pricing throughout the selling season, but was lower when compared to pricing in the third quarter of 2018. Moreover, during the 2019 sales season, one large allocation holder indicated that it is no longer supporting R-22 sales. Additionally, the remaining large allocation holders recently raised their R-22 price and we are currently experiencing the first price increase this year. We believe those actions, coupled with the ban of R-22 production and importation after 2019, will result in a tightening of R-22 supply for the 2020 selling season.

“We remain confident in the long-term opportunities for our business, particularly as we sell through the higher priced R-22 acquired with the Airgas acquisition, which we expect will result in a margin level more in line with our historical performance. The demand for cooling systems remains strong and our positioning at two key points in the supply chain, along with our ability to provide any refrigerant, anywhere at any time, remains a competitive strength as we close out 2019 and move into 2020.”

Conference Call Information

The Company will host a conference call and webcast today, Thursday, November 14, 2019 at 5:00 p.m. Eastern Time, to discuss the Company’s third quarter results.

To access the live webcast, log onto the Hudson Technologies website at www.hudsontech.com, and click on “Investor Relations”.

To participate in the call by phone, dial (877) 407-9205 approximately five minutes prior to the scheduled start time. International callers please dial (201) 689-8054.

A replay of the teleconference will be available until December 14, 2019 and may be accessed by dialing (877) 481-4010. International callers may dial (919) 882-2331. Callers should use conference ID: 56807.