PEARL RIVER, NY – NOVEMBER 3, 2021 – Hudson Technologies, Inc. (NASDAQ: HDSN) announced results for the third quarter and nine months ended September 30, 2021.

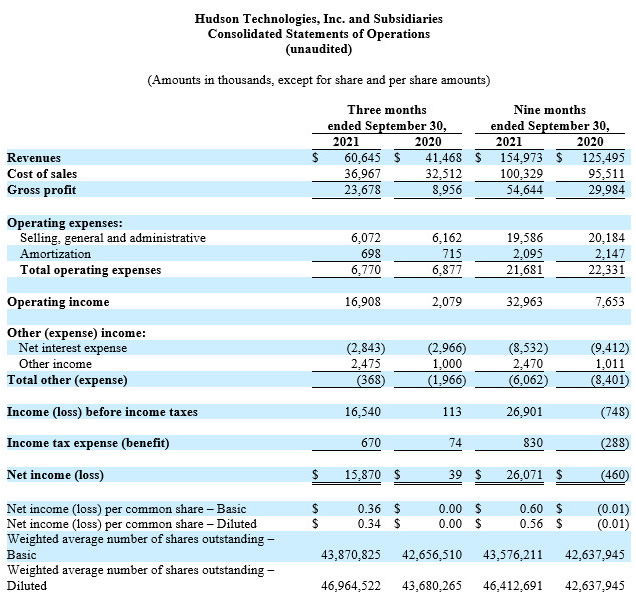

For the quarter ended September 30, 2021, Hudson reported revenues of $60.6 million, an increase of 46% compared to revenues of $41.5 million in the comparable 2020 period. Third quarter revenue growth was driven by increased selling prices of certain refrigerants during the period. Gross margin in the third quarter of 2021 was 39%, compared to 22% in the third quarter of 2020, mainly due to the aforementioned increase in selling price of certain refrigerants. Hudson reported operating income of $16.9 million in the third quarter of 2021, compared to operating income of $2.1 million in the prior year period. The Company recorded net income of $15.9 million or $0.36 per basic and $0.34 per diluted share in the third quarter of 2021, compared to net income of $39 thousand or $0.00 per basic and diluted share in the same period of 2020.

For the nine months ended September 30, 2021, Hudson reported revenues of $155.0 million, an increase of 24% compared to revenues of $125.5 million in the first nine months of 2020. The revenue growth was driven by increased selling prices for certain refrigerants during the period. Gross margin during the nine months ended September 30, 2021 was 35%, compared to 24% in the first nine months of 2020, mainly due to the aforementioned increase in selling price of certain refrigerants. Hudson reported operating income of $33.0 million for the first nine months of 2021 compared to operating income of $7.7 million in the prior year period. The Company recorded net income of $26.1 million or $0.60 per basic and $0.56 per diluted share in the first nine months of 2021, compared to a net loss of $0.5 million or ($0.01) per basic and diluted share in the same period of 2020.

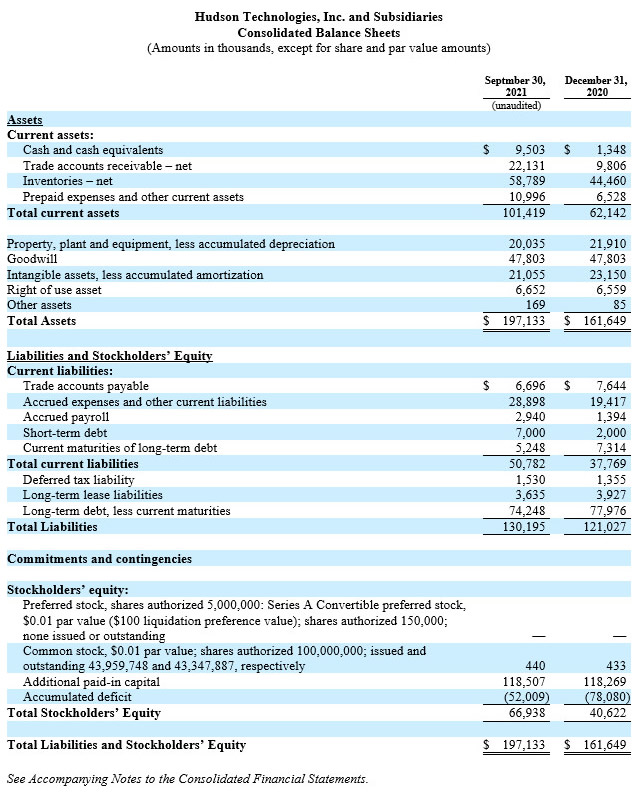

At September 30, 2021, the Company had approximately $53 million of total availability, consisting of cash and cash equivalents plus revolving loan availability.

Brian F. Coleman, President and Chief Executive Officer of Hudson Technologies commented,

“The close of the third quarter represents a strong finish to our traditional nine month selling season. We’re pleased to have delivered substantial revenue growth, increased margins and enhanced profitability in the quarter and for the 2021 selling season. Our improved performance was primarily related to significantly increased average selling prices of certain refrigerants, partially offset by reduced demand volume due to both a greater focus on higher margin customers as we have realigned our sales strategy, and a slower than expected reopening of businesses. In addition, there has been a far greater disruption in the supply chain, both with product availability and transportation, which has impacted our entire industry, as well as the overall economy. We’re focused on proactively managing our inventory so that we will be well positioned to continue to serve our customer base throughout the 2022 cooling season.

“In September, the EPA published the final rule allocating allowances for the production and consumption of HFCs, as mandated by the AIM Act, introducing a stepdown of 10% in 2022 from baseline levels. As we expected, Hudson received an allocation allowance for calendar year 2022 equal to approximately 3 million Metric Tons Exchange Value Equivalents, or 1% of the total HFC consumption allocation, with allowances for 2023 and beyond to be determined at a later date. Notably, subsequent allowances must establish a 40% reduction in virgin production and importation from the current baseline, in 2024. We expect the reduction in virgin HFC supply will help accelerate reclamation activity in the near term and with the final HFC allowances in place, we believe we are competitively positioned through both our reclamation capabilities and our robust distribution network, to capture market share as both a supplier and a reclaimer, serving the large and growing installed base of HFC equipment. Please remember that our technology has the ability to service and reclaim any refrigerant, including next generation HFOs, well into the future. We support the global efforts to transition our industry to more environmentally friendly gases, and believe we have a unique opportunity to provide a sustainable alternative to virgin refrigerants as the HFC supply tightens,” Mr. Coleman concluded.