- Third Quarter Revenue of $61.9 million

- Net income of $7.8 million or $0.17 per diluted share

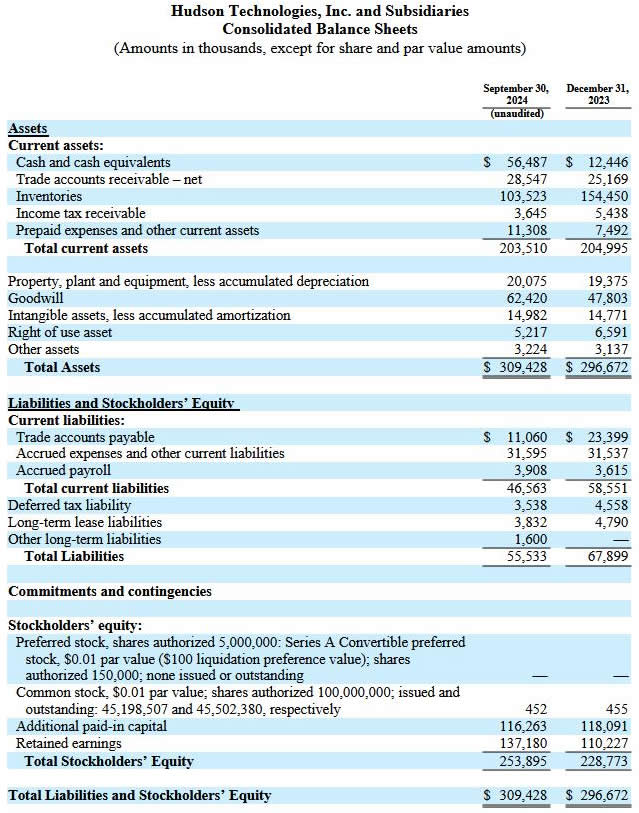

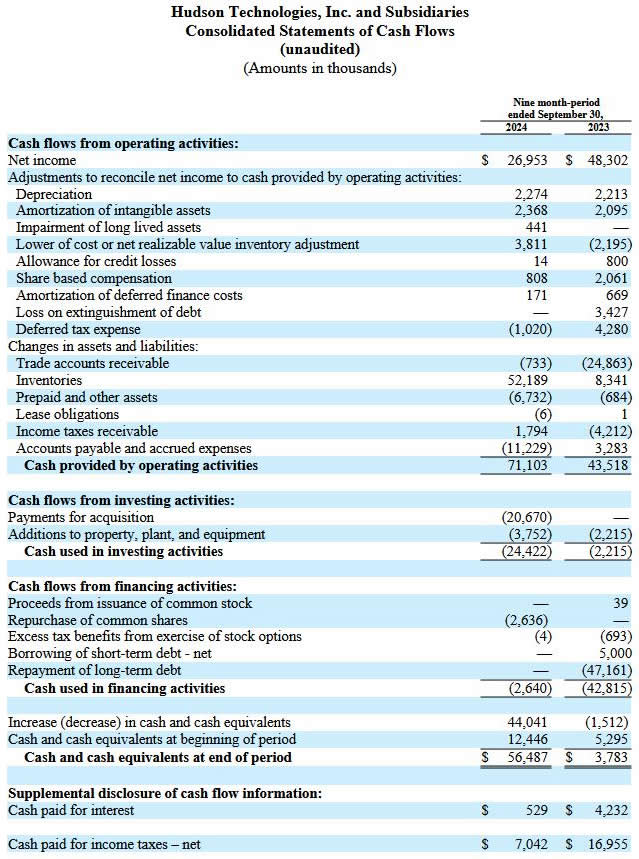

- Strengthened balance sheet with $56.5 million in cash and no debt

- Repurchased $2.6 million of common stock during the third quarter

WOODCLIFF LAKE, NJ – November 4, 2024 – Hudson Technologies, Inc. (NASDAQ: HDSN) announced results for the third quarter and nine months ended September 30, 2024.

Brian F. Coleman, President and Chief Executive Officer of Hudson Technologies commented,

“Our third quarter results reflected continued pricing pressure that persisted for certain refrigerants throughout the 2024 cooling season. While disappointing in the near term, pricing trends are only one element of our business model and we remain confident in our long-term growth strategy to capitalize on the phasedown of HFC refrigerants and the expected corresponding growth in demand for reclaimed refrigerants. With our current visibility, we are adjusting our expectation for full year 2024 revenue, which we anticipate will be at the low end of the guidance range we previously provided, with full year gross margin of approximately 28%.

“The EPA recently finalized the Refrigerant Management rule pursuant to subsection (H) of the AIM Act, providing reclaim mandates for use in servicing certain sectors of the market beginning in 2029, and we view this as a positive step in the industry’s transition to the broader use of reclaimed refrigerants. Throughout our many decades in the refrigerant industry we have remained focused on the elements of our business we can control: ensuring that our customers have reliable supply of the refrigerants they need and promoting recovery and reclamation activities to enable the ongoing evolution to more efficient equipment and sustainable refrigerant management practices.

“Our unlevered balance sheet strengthened during the quarter with no debt and $56.5 million in cash at September 30, 2024. Additionally, during the quarter, as part of our capital allocation strategy, we repurchased $2.6 million of common stock under our recently established stock buyback plan,” Mr. Coleman concluded.

Three Months Results

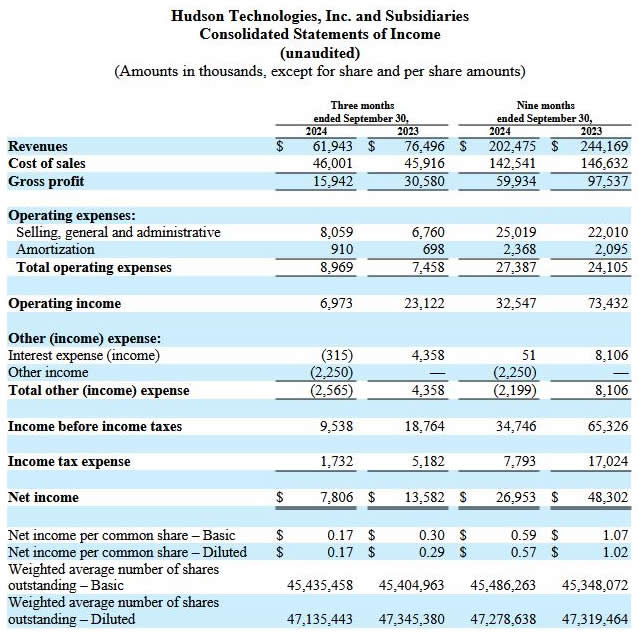

For the quarter ended September 30, 2024, Hudson reported:

- Revenues of $61.9 million, a decrease of 19% compared to revenues of $76.5 million in the comparable 2023 period. The decrease is primarily related to decreased prices for certain refrigerants, as well as slightly lower revenue from the Company’s DLA contract in the quarter compared to the third quarter of 2023.

- Gross margin of 26%, compared to 40% in the third quarter of 2023.

- Selling, general and administrative expenses increased to $8.1 million compared to $6.8 million in the third quarter of 2023, primarily related to higher personnel costs and professional fees.

- Operating income of $7.0 million, compared to operating income of $23.1 million in the prior year period.

- Net income of $7.8 million or $0.17 per basic and diluted share in the third quarter of 2024, compared to net income of $13.6 million or $0.30 per basic and $0.29 per diluted share in the same period of 2023. Of note, net income for the third quarter of 2024 included approximately $2.3 million of non-recurring income, arising in part from proceeds of a litigation settlement.

Nine Months Results

For the nine months ended September 30, 2024, Hudson reported:

- Revenues of $202.5 million, a decrease of 17% compared to revenues of $244.2 million for the first nine months of 2023. Revenues declined primarily due to decreased selling prices for certain refrigerants as well as lower revenue from the Company’s DLA contract.

- Gross margin of 30%, compared to gross margin of 40% in the first nine months of 2023.

- Selling, general and administrative expenses increased to $25.0 million compared to $22.0 million in the first nine months of 2023. Included in the year to date, 2024 selling, general and administrative expenses are approximately $0.7 million of non-recurring costs associated with the USA acquisition and IT expenses

- Operating income of $32.5 million compared to operating income of $73.4 million in the first nine months of 2023.

- Net income of $27.0 million or $0.59 per basic and $0.57 per diluted share, compared to net income of $48.3 million or $1.07 per basic and $1.02 per diluted share in the first nine months of 2023. Net income in the first nine months included approximately $2.3 million of non-recurring income, arising in part from proceeds of a litigation settlement as mentioned above.

The Company announced the establishment of a stock repurchase program during the third quarter of 2024, under which it repurchased $2.6 million of common stock. Additionally, subsequent to the close of the quarter, on October 25, 2024 Hudson announced that its board of directors approved an increase to the Company’s share repurchase program. Hudson may now purchase up to $20 million in shares of its common stock, consisting of up to $10 million in shares during each of calendar year 2024 and 2025. The Company had previously announced that its board had authorized the repurchase of $10 million of outstanding common stock during 2024 and 2025.